Take Control of Your Finances

Personal finance is all about managing your money to achieve stability and reach your goals. It’s budgeting, saving, investing, and making informed financial decisions.

Just like taking care of your health, managing your finances is important for building a happy and fulfilling life. When you understand where your money goes and plan for the future, you gain control and reduce stress.

Whether you’re paying off debt, saving for something special, or planning for retirement, mastering personal finance gives you the freedom and confidence to live the life you want.

Table of Contents

Personal Finance Power-Ups

If you’d like to read more about how to improve your personal finances, be sure to check out our collection of articles below.

What Is Personal Finance?

At its core, personal finance is about how you earn, spend, save, and invest money. It includes budgeting, saving, investing, and planning for big life events like buying a home (which seems harder now than ever), retirement, or handling unexpected expenses.

Why is Personal Finance Important?

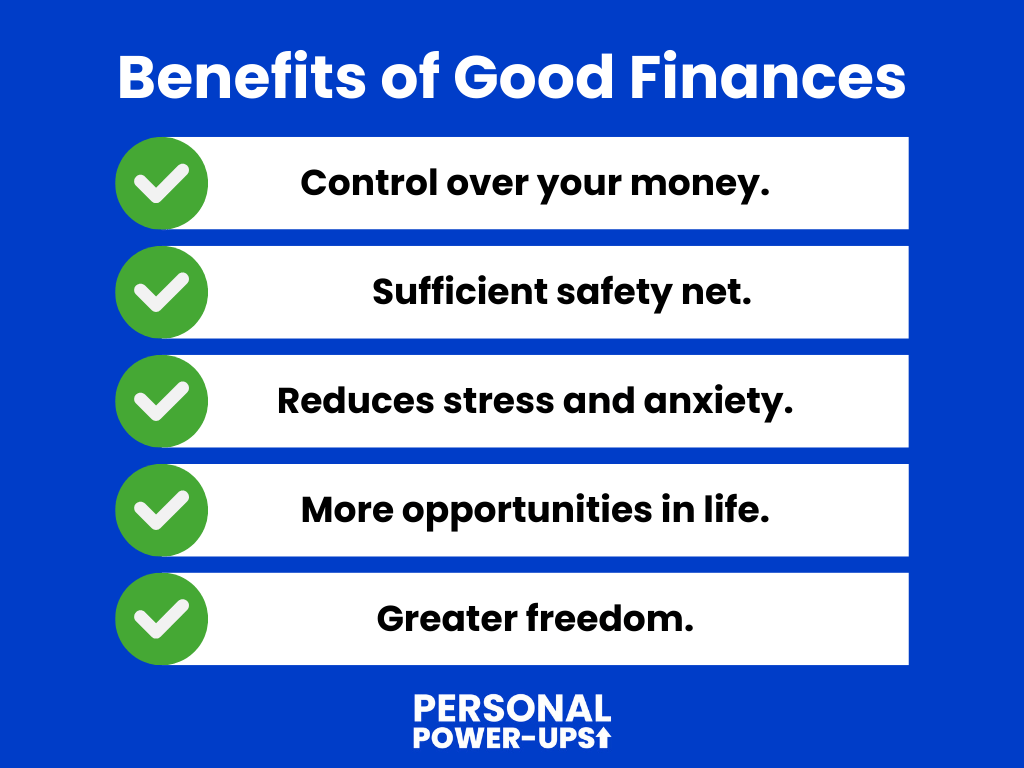

Personal finance is important because it gives you control over your money and helps you secure your financial future. When you manage your finances well, you can cover your day-to-day needs, avoid debt, invest your money, and plan for big goals like buying a home, starting a business, or retiring comfortably.

Good personal finance habits also help you build a safety net for unexpected situations, like medical emergencies or job loss. This reduces financial stress because you know you’re prepared for whatever comes your way.

Plus, managing your money wisely gives you more opportunities and freedom, whether it’s saving for a vacation, investing for growth, or retiring early.

How Can I Improve My Personal Finance Skills & Knowledge?

Improving your personal finance skills and knowledge takes time and effort, but there are several great steps you can take right now.

First of all, begin by educating yourself, as this improves your financial literacy. There are countless resources like books, blogs (like this one), podcasts, and online courses that break down the basics of investing, budgeting, saving, and debt management. Start small, one topic at a time, like how to create a budget or what a bull market and bear market is.

Next, be sure put what you learn into action. Create a budget to track your income and expenses, for example. Know where your money is going, as this helps you make better spending decisions and gives you control over your finances. Once you have a handle on your spending, start setting financial goals, like building an emergency fund or saving more each month.

It’s also important to review and adjust your results. So track your progress toward your financial goals and see where you can make improvements. Perhaps you must cut unnecessary expenses (no more than one streaming service at at time?), shift from poor to rich thinking, or find ways to boost your income and savings.

Advice from financial experts or mentors is another great way to improve. You can talk to a financial advisor for personalized guidance, or even learn from others around you who have successfully managed their finances.

Personal finance is a lifelong process, and small, consistent improvements add up over time. So let’s get started right now and read some articles about personal finance above!

How Much Money Do I Need to Retire (Early)?

It’s important to be aware of your retirement fund, no matter your age. The earlier you start, the easier it’ll be to invest for your retirement, especially if you want to retire early. We’ve developed several tools to help you calculate how much money you need to retire (early):

- A Barista FIRE Calculator if you’d like to retire but still want to do some work you enjoy on the side.

- A FIRE Calculator if you want to retire early through saving and investing.